Introduction

Risk scenarios describe in detail the asset at risk, who or what can act against it, their intent or motivation (if applicable), the circumstances and threat actor methods associated with the threat event, the effect on the company if/when it happens, and when or how often the event might occur. All Risk Scenarios in SAFE are fully FAIR-compliant and built upon the FAIR methodology.

SAFE provides an Out-of-the-Box (OOTB) Risk Scenario Library, offering a comprehensive set of pre-defined Risk Scenarios to expedite the risk assessment process.

Each Risk Scenario generates key risk assessment outputs, including:

Likelihood

Loss Magnitude

Annualized Loss

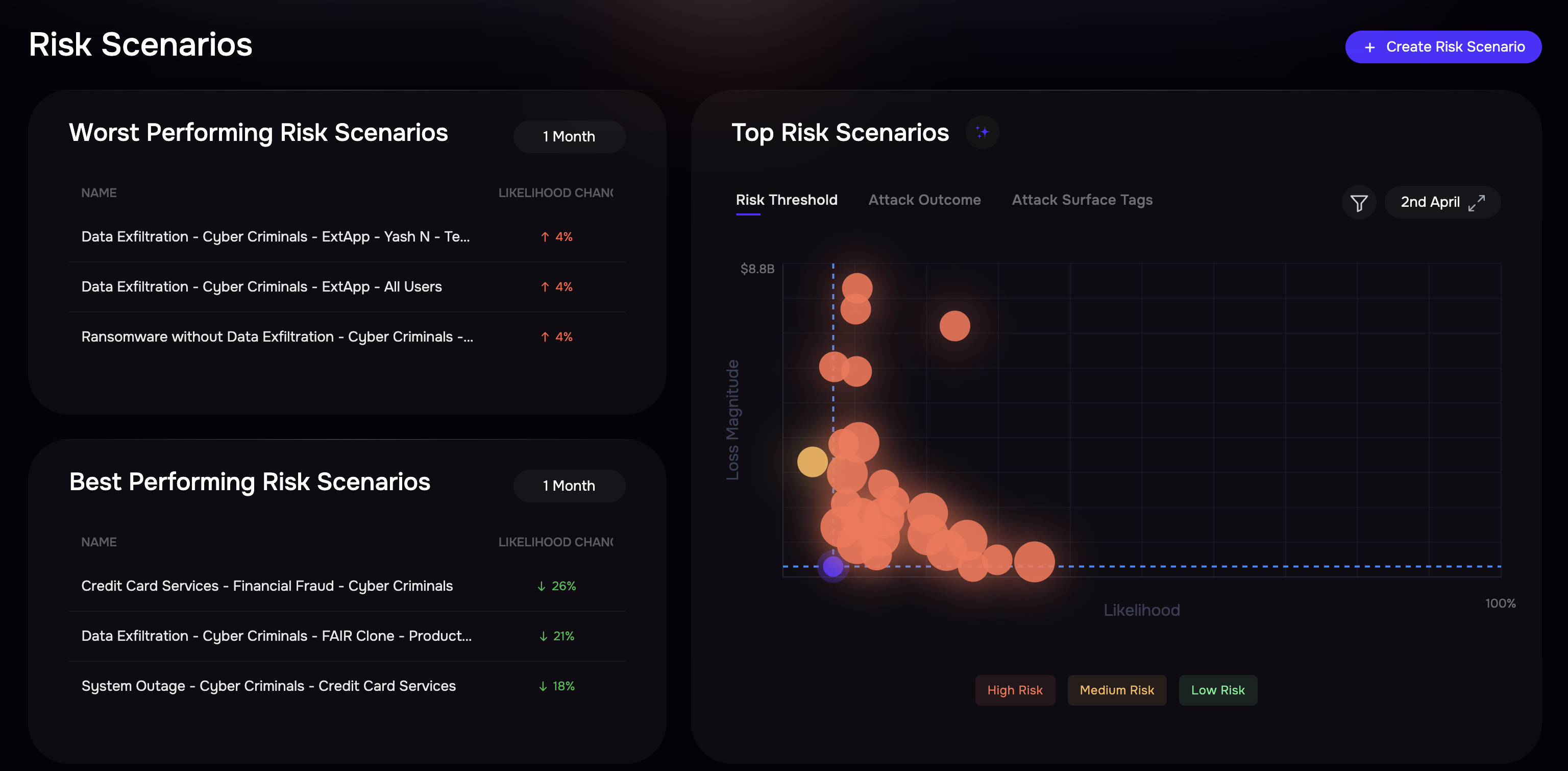

The Risk Scenario page in SAFE provides an overview of risk scenarios and key insights. It includes:

Top Risk Scenario Bubble Graph: A visual representation of Likelihood vs. Loss Magnitude.

Worst Performing Risk Scenarios: Displays high-risk scenarios requiring attention.

Best Performing Risk Scenarios: Shows scenarios with lower risk impact.

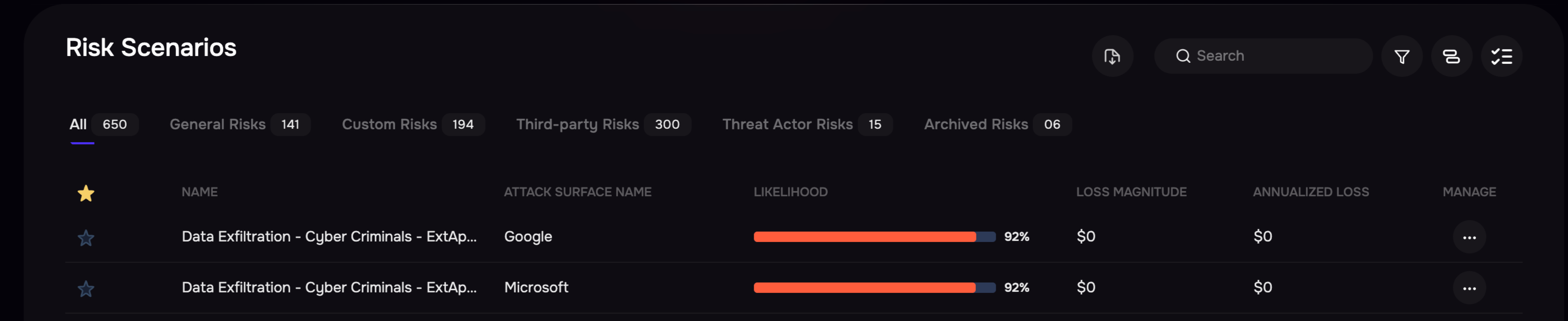

Risk Scenarios Table: Displays all available risk scenarios with filtering and grouping options.

Managing the group list table

You can group the risk scenario table, apply filters, manage columns, search, and export the group list.

Grouping: You can group risk scenarios based on:

Risk Scenario Category

Attack Outcome

Threat Actor

Initial Attack Methods

More Actions

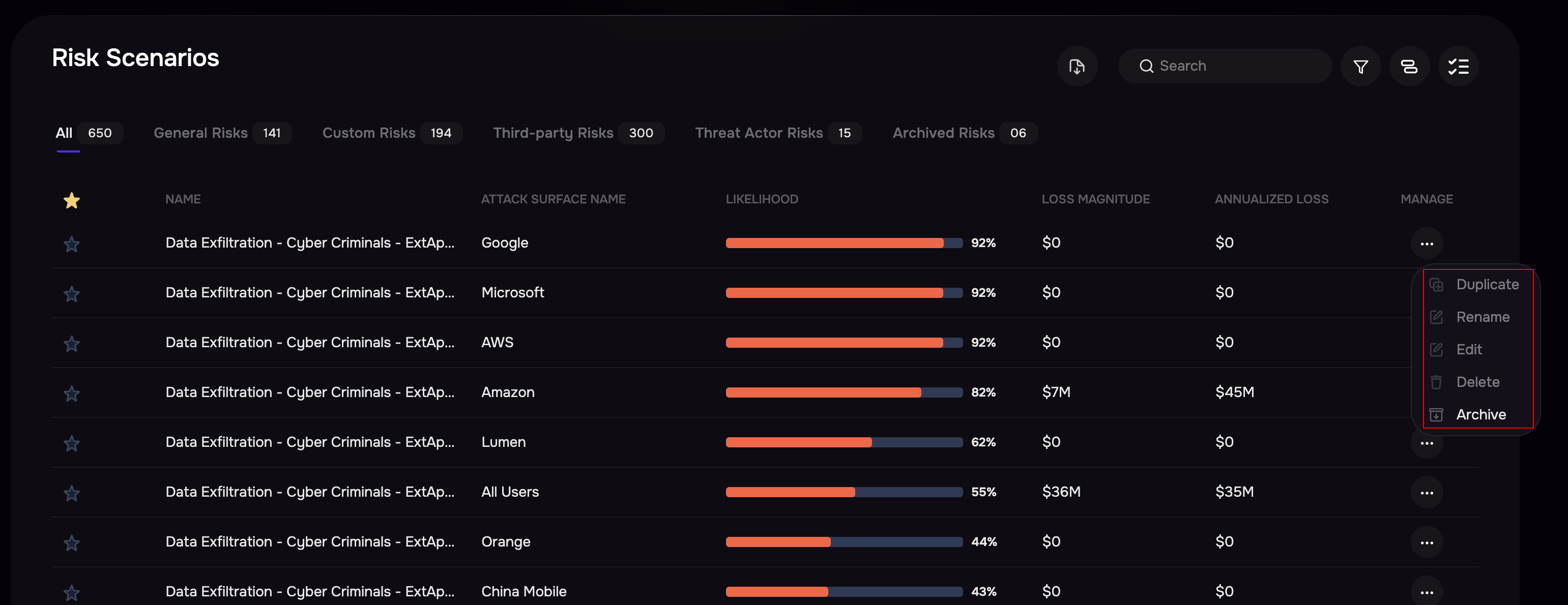

Each Risk Scenario has a three-dot options menu providing the following actions:

Edit: Redirects you to the five-step wizard for updating scenario details.

Duplicate: This creates a duplicate of the risk scenario with existing details.

Note on Loss Driver

When you duplicate a risk scenario from one group (source) to another (target), only the overridden loss drivers from the source will be copied over. The remaining loss driver values will automatically adjust based on the target group's assessments and revenue.

Delete: Removes the selected risk scenario.

Archive: Moves the scenario to archived records.

Rename: Allows renaming the risk scenario.

Risk Scenario Details

Clicking on a Risk Scenario opens its detail page, which includes:

AI Summary

Likelihood and Loss Magnitude

Risk Scenario Composition and related details

The detail page also allows you to perform various actions such as:

Switch to Controls and Findings View

What-If Analysis

See What Changed

MITRE ATT&CK View

Control View